If you’re in the business of online content creation, you’re likely familiar with copyright and its exclusive rights for creators.

However, copyright is a vast legal concept, and it’s important to grasp how it functions, benefiting your creations and business, and influencing your financial aspects.

This brings us to a significant facet of copyright – depreciation. While you’re aware of physical assets undergoing depreciation, the question arises: Is copyright, as an asset, depreciable too?

In this article, we’ll discuss the financial aspects of copyright for creators. We’ll explore whether copyright is depreciable and what that means for creators and business owners in the digital age.

- Copyright itself is not considered a depreciable asset in the traditional accounting sense

- Within the provisions of Section 197, copyrights undergo a process known as amortization.

- Intellectual property, including copyrights, is amortized for 15 years, reflecting its legal or useful life.

Table of Contents

Is Copyright Depreciable?

Yes, copyright can be considered a depreciable asset for accounting and tax purposes in many jurisdictions. Copyright is an intangible asset, and like other intangible assets, it can be depreciated over its useful life. The useful life of a copyright is typically the life of the author plus a certain number of years, which varies depending on the country’s laws.

Unlike tangible assets that undergo physical wear and tear, copyright is an intangible asset and, for tax purposes, falls under the provisions of Section 197 of the U.S. Internal Revenue Code.

Section 197 intangibles cover a broad range of certain intangible assets, including but not limited to goodwill, trademarks, patents, copyrights, customer lists, and franchise rights.

Within the provisions of Section 197, copyrights undergo a process known as amortization. This acknowledges that the value of copyrights doesn’t diminish due to physical wear and tear but rather diminishes over time as the economic benefits associated with the copyright are realized.

Amortization, with a standardized period of 15 years, allows for a systematic and gradual allocation of the costs incurred in acquiring copyrights, aligning with the intangible and enduring nature of these assets.

The typical duration of copyright protection varies depending on the type of work and the jurisdiction.

In general, copyright protection lasts for the life of the author plus a certain number of years. Copyright typically extends for the author’s lifetime plus 70 years in many countries.

The treatment of copyright as a non-depreciable asset and the application of amortization under Section 197 provides businesses and creators with a systematic and fair approach to account for the acquisition costs associated with these valuable intangible assets.

In broader legal contexts, understanding how copyright works, such as the copyright first sale doctrine, can also be useful. While it governs the rights around distribution and resale, it intersects with how businesses think about the value and control of intellectual property over time.

What is Depreciation in the Context of Intellectual Property?

When it comes to intellectual property like copyrights, depreciation gets complicated. Unlike physical things that wear down, intellectual property is intangible and needs a more careful accounting approach.

Managing intellectual property, especially copyrights, involves facing numerous complexities. Unlike physical assets, the intangible nature of the property brings challenges in assessing its value and handling depreciation.

These challenges include:

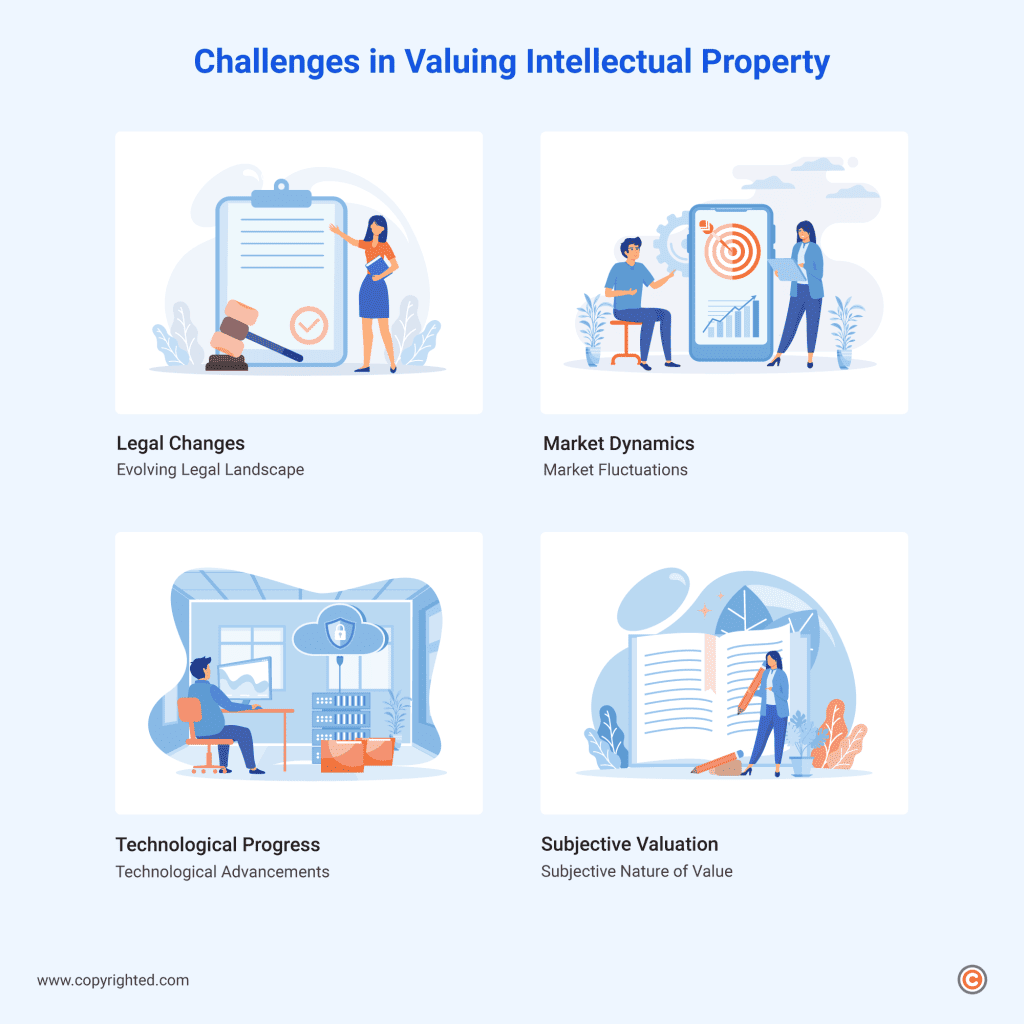

- Subjective Nature of Value: Intellectual property, including copyright, derives its worth from creative or innovative expressions. The subjective nature of this value poses a challenge in quantifying and objectively assessing the economic impact of intellectual property assets.

- Dynamic and Evolving Legal Landscape: The legal framework surrounding intellectual property, including copyright laws, is dynamic and subject to frequent changes. Keeping updated on these evolving regulations is essential, as shifts in legal perspectives can significantly impact the value and treatment of intellectual property assets.

- Consistent and Universally Accepted Depreciation Method: Determining a standard and universally accepted method for depreciating intellectual property remains challenging. The absence of a one-size-fits-all approach complicates financial reporting, as businesses may adopt varying methods based on interpretation and application.

- Technological Advancements: Rapid technological advancements introduce complexities in valuing and depreciating intellectual property. Changes in technology can quickly render certain intellectual property obsolete or significantly alter its market relevance, challenging the predictability of depreciation.

- Market Fluctuations: Intellectual property values are often influenced by market dynamics, which can be volatile. Fluctuations in demand, consumer preferences, and market trends pose challenges in estimating the ongoing economic benefits and, consequently, the depreciation schedule.

- Legal Developments: Intellectual property laws are subject to ongoing developments, including court decisions and international agreements. Staying informed about these legal shifts is critical for accurate and compliant financial reporting, adding another layer of complexity to the management of intellectual property assets.

Additionally, when evaluating value over time, one might ask, what is economic copyright? This concept touches on the practical, income-generating aspects of copyright ownership and how they impact financial assessments, licensing decisions, and long-term strategy.

Awareness of these challenges is important for businesses and creators alike in optimizing the financial aspects associated with their intellectual property assets.

Frequently Asked Questions

Why is applying depreciation to intangible assets challenging?

Traditional depreciation models are designed for physical assets, not intangibles. Intangibles, like copyrights, are subject to valuation complexities, which can make it difficult to determine its depreciation.

What is the depreciation method for copyright?

Instead of being depreciated, intangible assets like copyright are amortized. Amortization allocates costs over 15 years under Section 197 of the U.S. tax code.

How long to depreciate intellectual property?

Intellectual property, including copyrights, is amortized over 15 years, reflecting its legal or useful life.

How do you amortize copyright?

Amortizing copyright is done using the straight-line method, evenly spreading acquisition costs over its legal or useful life. This ensures a consistent and predictable allocation of expenses each year.

How might the depreciable nature of copyrights impact creators and businesses?

Copyright is not depreciable, it’s amortizable. This provides a fair way to allocate costs, impacting financial planning and compliance with tax regulations.